BTP Plus: A Secure Investment for Savers?

Table of Contents

- 1. BTP Plus: A Secure Investment for Savers?

- 2. Coupon Rates and Potential Variability

- 3. BTP Plus Compared to Deposit Accounts

- 4. Considerations for Investing in BTP Plus

- 5. Global Economic Uncertainty and BTP Più Performance

- 6. Expert Insights

- 7. BTP Plus: A Secure Investment for Savers?

- 8. Coupon Rates and Potential Variability

- 9. BTP Plus vs. Deposit Accounts

- 10. BTP Più: An Attractive Option for Conservative Investors?

- 11. Potential for Higher Long-Term returns

- 12. Guaranteed principal with Deposit Accounts

- 13. Key Considerations for Investing in BTP Più

- 14. The Future of BTP Più

- 15. Given the guaranteed minimum interest rates offered by BTP Più, especially in the context of the current low-interest-rate habitat, what factors beyond risk tolerance should potential investors carefully consider before deciding whether BTP Più aligns with their investment goals?

- 16. BTP Più: A Secure Investment for Savers?

- 17. Interview with Marco Rossi

In an effort to attract savers, the Italian Ministry of Economy and Finance (MEF) has introduced BTP Più, a novel state-guaranteed bond.The bond issuance concluded on February 21st, 2023, offering guaranteed minimum interest rates of 2.80% for the initial four years and 3.60% for the subsequent four years.

Coupon Rates and Potential Variability

While these figures represent the assured minimum rates, the final coupon rates for BTP Più are subject to adjustment based on prevailing market conditions at the time of issuance. “Challenging to anticipate the collection that the MEF will be able to make,” market sources note, highlighting a key uncertainty factor: the global risk-inflation environment compounded by complex geopolitical scenarios and ongoing trade tensions.The definitive coupon rates will be announced at the conclusion of the placement period.

BTP Plus Compared to Deposit Accounts

Financial analysts are naturally comparing BTP Più to traditional deposit accounts. Recent simulations indicate that BTP Più may offer a more compelling return for long-term investors, considering the higher interest rates and potential for capital appreciation tied to inflation.

Considerations for Investing in BTP Plus

Before investing in BTP Più, potential investors should carefully consider several factors:

- Risk Tolerance: While BTP Plus is a state-guaranteed bond, it is indeed still subject to market fluctuations. Investors should assess their risk tolerance and ensure that the investment aligns with their overall financial goals.

- Investment Horizon: BTP Plus has a maturity of eight years. Investors should have a long-term investment horizon to fully benefit from the potential returns.Early withdrawals may incur penalties.

- Inflation Expectations: BTP Plus offers a potential hedge against inflation, but investors should monitor inflation trends and adjust their investment strategy accordingly.

- Diversification: As with any investment, diversification is crucial. BTP Plus should be considered as part of a well-diversified portfolio.

Global Economic Uncertainty and BTP Più Performance

The global economic outlook remains uncertain,with ongoing geopolitical tensions and inflationary pressures. these factors could potentially impact the performance of BTP Più.However, the state guarantee provides a level of security against major market downturns.

Expert Insights

“The introduction of BTP Più represents an innovative approach by the MEF to encourage savings and provide investors with a potentially attractive long-term investment option,” states Marco Rossi, Senior Analyst at Italfin Partners.

Rossi emphasizes the importance of carefully considering individual risk tolerance and investment goals before investing in BTP Più. “In the current global economic environment, investors need to be particularly discerning and seek opportunities that offer both potential returns and a degree of security,” he concludes. “BTP Più, with its state guarantee, may offer a compelling proposition for investors with a long-term perspective.”

For savers seeking a secure investment option with potentially higher returns than traditional deposit accounts, BTP Più might potentially be worth considering. However, it is essential to conduct thorough research, understand the risks involved, and seek professional advice if needed.

BTP Plus: A Secure Investment for Savers?

Italy’s Ministry of Economy and Finance has launched BTP Più, a new type of government-backed bond aimed at attracting savers seeking higher returns. Offering guaranteed minimum interest rates starting at 2.80% for the first four years, rising to 3.60% for the subsequent four, BTP Più presents an appealing proposition in the current low-interest-rate environment. Though, potential investors need to carefully consider the risks and benefits associated with this innovative offering.

Coupon Rates and Potential Variability

While the guaranteed minimum rates are enticing, investors should be aware that the final coupon rates are subject to market conditions. Global economic uncertainty, characterized by inflation, geopolitical tensions, and fluctuating markets, introduces inherent variability. Marco Rossi, Senior Analyst at Italfin Partners, emphasizes the need for careful risk assessment: “Global financial markets are experiencing considerable volatility. predicting how these factors will influence the final coupon rates at the end of the placement period is challenging. Investors need to be aware of this inherent uncertainty and carefully assess their risk tolerance.”

BTP Plus vs. Deposit Accounts

BTP Più offers potentially higher returns compared to traditional deposit accounts, but with increased risk. Deposit accounts generally provide lower but guaranteed returns,offering stability in uncertain economic times. Choosing between BTP Plus and deposit accounts depends on individual investment goals, risk appetite, and financial circumstances. Investors seeking higher returns and pleasant with potential market fluctuations might find BTP Plus attractive. Conversely, individuals prioritizing capital preservation and predictable income might prefer the security of deposit accounts.

Before investing in BTP Più, thorough research is crucial.Understanding the potential impact of global economic uncertainty on bond yields, consulting with a financial advisor, and diversifying investments across different asset classes are essential steps for making informed decisions. Staying informed about economic developments and bond market trends will also help investors navigate this evolving landscape effectively.

BTP Più presents both opportunities and challenges for Italian savers. While the potential for higher returns is alluring, investors must carefully weigh the associated risks. Thorough research, professional guidance, and a well-balanced investment strategy are crucial for navigating this complex financial landscape and achieving long-term financial security.

BTP Più: An Attractive Option for Conservative Investors?

As inflation continues to impact savings accounts, many investors are exploring alternatives to traditional deposit accounts. One such option is BTP Più, a type of Italian government bond designed to offer predictable returns.

While BTP Più presents a potentially lucrative prospect, it’s crucial to understand both its advantages and disadvantages compared to traditional deposit accounts.

Potential for Higher Long-Term returns

“in the long term, BTP Più might offer potentially higher returns compared to deposit accounts,” explains financial expert Marco Rossi. “This is primarily due to the fixed interest rate structure coupled with the potential for capital appreciation tied to inflation.”

This means that your investment could grow at a faster pace than a traditional savings account, especially if inflation rates remain elevated.

Guaranteed principal with Deposit Accounts

On the other hand, deposit accounts offer a sense of security with guarantees of principal at maturity. This makes them a popular choice for risk-averse investors who prefer stability over potentially higher returns.

As Rossi points out,”deposit accounts typically offer greater liquidity and guaranteed principal at maturity.”

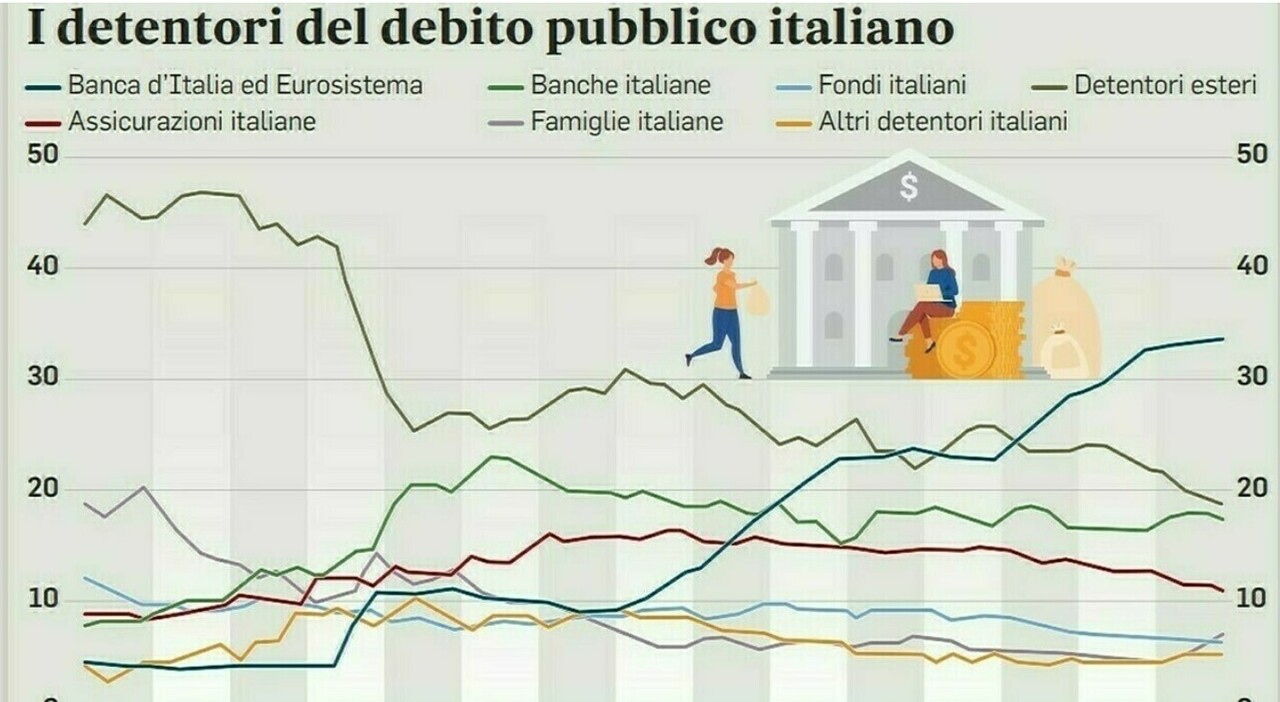

[Infographic comparing BTP Più and Deposit accounts]

Key Considerations for Investing in BTP Più

Before making any investment decisions, thorough research is essential. While BTP Più can be attractive for conservative investors,it’s important to:

understand the Risks: Like any investment,the value of BTP Più can fluctuate.It’s not a risk-free option.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying across different asset classes can definitely help mitigate risk.* Consult a Financial Advisor: Seek professional guidance to determine if BTP Più aligns with your individual financial goals and risk tolerance.Rossi emphasizes, “It’s crucial to understand the associated risks. It’s essential to diversify your portfolio and consult with a financial advisor to determine if BTP Più aligns with your individual investment goals and risk profile.”

The Future of BTP Più

the future of BTP Più is closely tied to the global economic landscape.”If inflation persists and interest rates remain elevated, BTP Più could become even more appealing to savers seeking predictable returns,” Rossi suggests. However, he also cautions that “unforeseen events and market shifts could impact its performance. It will be captivating to monitor its growth and see how it performs in the coming years.”

What are your thoughts on BTP Più? Is it a sound investment option in the current economic climate? Share your insights in the comments below.

Given the guaranteed minimum interest rates offered by BTP Più, especially in the context of the current low-interest-rate habitat, what factors beyond risk tolerance should potential investors carefully consider before deciding whether BTP Più aligns with their investment goals?

BTP Più: A Secure Investment for Savers?

Italy’s Ministry of Economy and Finance has launched BTP Più, a new type of government-backed bond aimed at attracting savers seeking higher returns. Offering guaranteed minimum interest rates starting at 2.80% for the first four years, rising to 3.60% for the subsequent four, BTP Più presents an appealing proposition in the current low-interest-rate environment. Though, potential investors need to carefully consider the risks and benefits associated with this innovative offering. To delve deeper into this topic, we spoke with Marco Rossi, a Senior Financial Analyst at Italfin Partners.

Interview with Marco Rossi

Archyde News: mr. Rossi, thanks for taking the time to speak with us. Can you provide our readers with a clear understanding of what BTP Più is and how it differs from conventional Italian government bonds?

Marco Rossi: Certainly. BTP Più is a new type of government bond issued by the Italian Ministry of Economy and Finance (MEF). What sets it apart is its focus on providing a guaranteed minimum return for investors over an eight-year period.

The coupon rates are specifically structured,starting with a guaranteed 2.80% for the first four years and then increasing to 3.60% for the remaining four years. This offers investors greater predictability and potential for growth compared to traditional BTP bonds, where yields are subject to market fluctuations.

Archyde News: This guaranteed return structure sounds attractive, especially in the current economic climate. What risks, if any, should potential investors be aware of?

Marco Rossi: It’s vital to remember that while BTP Plus is a government-backed bond, it is not without risk. While the minimum rates are guaranteed, the final coupon rates could be subject to adjustments based on market conditions at the end of the placement period.

global economic uncertainty, inflation, and geopolitical tensions can all impact bond yields.It’s crucial for investors to understand these potential fluctuations and carefully assess their risk tolerance before making a decision.

Archyde news: How does BTP Più compare to traditional deposit accounts in terms of investment potential and risk?

Marco Rossi:

That’s a great question. Deposit accounts generally offer lower, guaranteed returns, emphasizing capital preservation. BTP Più,on the other hand, offers the potential for higher returns due to its structured interest rate increases,but it does come with the added risk associated with market fluctuations. The best choice depends on an individual’s investment goals, risk appetite, and financial circumstances.

Archyde News: What would you say to potential investors who are considering BTP Più as part of their investment strategy?

Marco Rossi: Thorough research is paramount. It’s essential to understand the risks involved, diversify your portfolio, and consider consulting with a financial advisor to determine if BTP Più aligns with your individual financial goals.

Remember,investments should always be made after careful consideration of your circumstances and risk tolerance.

Archyde News: Thank you for your insightful perspectives, Mr. Rossi.