Binance Coin Bullish Streak Continues Amidst Market Downturn

Table of Contents

- 1. Binance Coin Bullish Streak Continues Amidst Market Downturn

- 2. BNB Smart Chain Leads the Way

- 3. Trading Activity Spikes

- 4. A Bullish Outlook

- 5. BNB price Surge: Growing Confidence and Increased Trading Activity

- 6. Growing Confidence in the BSC Ecosystem

- 7. Surge in Buying Volume on Perpetual Markets

- 8. Implications for BNB Price

- 9. BNB’s Resilient rise: Against the Tide of Exchange Flows

- 10. Practical Applications: Navigating Market Flows

- 11. BNB price Prediction: Will demand Push it Higher?

- 12. What is your outlook on the future price of BNB, and what factors do you believe will influence its trajectory?

- 13. BNB Price Surge: An Interview with Crypto Analyst, Ava Daniels

- 14. Q: Ava, BNB has seen a significant price rally in recent days. What are the key drivers behind this upward movement?

- 15. Q: you mentioned the growing TVL on BSC.Can you elaborate on its significance?

- 16. Q: What about the surge in buying volume on perpetual markets? How does that play a role?

- 17. Q: looking ahead, what do you foresee for BNB’s price trajectory?

- 18. Q: Any final thoughts for our readers on BNB or the cryptocurrency market in general?

Binance Coin (BNB) is defying the current market downturn, recently experiencing a surge in both on-chain volume and derivatives trading. Over the past 24 hours,BNB has climbed 2.14%, extending its weekly gain of 10.24% to trade at $670.98 as of now.

BNB Smart Chain Leads the Way

While other blockchains like Solana (SOL), Ethereum (ETH), Base, and Arbitrum (ARB) have seen volume declines in the past week, BNB Smart Chain stands out as the sole network with positive growth.This trend is reflected in the data from DeFiLlama, revealing a weekly volume surge of 66.63% to $31.194 billion, and a 24-hour volume of $3.735 billion, the highest among all chains.

Trading Activity Spikes

This surge in activity is mirrored in derivatives markets, with binance and OKX traders witnessing a corresponding increase in buying volume.This widespread interest suggests growing confidence in BNB’s future prospects.

A Bullish Outlook

Analysts predict that BNB is likely to continue its bullish trajectory, driven by these positive market signals. The sustained volume growth on BNB Smart Chain, coupled with the increased trading activity in derivatives markets, paints a promising picture for the cryptocurrency.

BNB price Surge: Growing Confidence and Increased Trading Activity

Binance Coin (BNB) has experienced a notable price rally in recent days, accompanied by a surge in trading volume across major cryptocurrency exchanges. This positive momentum is attributed to several factors, including a notable increase in the total value locked (TVL) within protocols on the Binance Smart Chain (BSC) and heightened buying activity from perpetual market traders.

Growing Confidence in the BSC Ecosystem

The TVL on BSC has witnessed a significant increase from $4.895 billion on February 3rd to $5.56 billion at the time of writing, representing a $665 million surge. This upward trend in TVL indicates growing confidence in the BSC ecosystem and its ability to attract and retain value.

“When ther’s a significant surge such as this—a $665 million increase in TVL—it suggests growing confidence in BNB, as renewed interest tends to lead to a price rally while supply across exchanges reduces at the same time,” explains a seasoned cryptocurrency analyst.

Surge in Buying Volume on Perpetual Markets

Data from major cryptocurrency exchanges, Binance and OKX, reveal a significant increase in buying volume for BNB among perpetual market traders. The Taker Buy Sell Ratio, which measures the ratio of buying to selling activity, has surged well above 1 on both platforms.

Binance shows a Taker Buy Sell ratio of 1.727, while OKX recorded a ratio of 2.33. A ratio above 1 indicates that there is more buying pressure than selling pressure in the market. The further the ratio deviates from 1, the stronger the buying sentiment becomes.

Implications for BNB Price

The combination of a rising TVL, increased buying pressure on perpetual markets, and a generally positive trend in the wider cryptocurrency market suggests thatBNB could continue its upward trajectory in the coming days and weeks.

However,it is essential to remember that cryptocurrency markets are highly volatile,and prices can fluctuate significantly. It is always recommended to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

BNB’s Resilient rise: Against the Tide of Exchange Flows

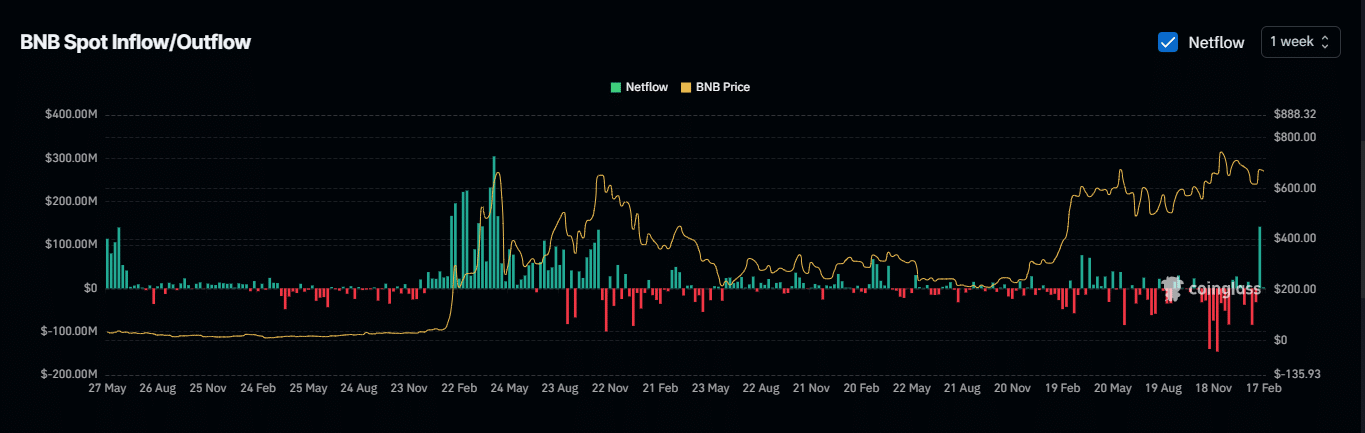

Despite a significant surge in exchange netflows, Binance Coin (BNB) has shown remarkable resilience, surging by 10% in the past week. This surge comes amidst a backdrop of increasing open interest in the cryptocurrency market, indicating growing investor confidence.

Between February 10th and 16th, the exchange netflow reached a remarkable $142 million, the highest as May 2021. This influx of assets into exchanges typically signals a bearish sentiment, as sellers look to liquidate their holdings.

However, BNB defied this trend, demonstrating strong demand from buyers. As noted by analysts, “This indicates that while there was a large sell volume on the spot market, there was a corresponding level of buying pressure.”

Adding to this bullish narrative is the increase in open interest. Open interest, which represents the total value of outstanding derivative contracts, saw a 1.78% rise, reaching $866.70 million.This surge in open interest suggests that traders are increasingly bullish on BNB’s future prospects, placing bets on further price gratitude.

Practical Applications: Navigating Market Flows

The interplay between exchange flows and open interest provides valuable insights for traders and investors alike. Understanding these dynamics can help you make more informed decisions in a volatile market:

- Monitor Exchange Flows: Keeping track of major exchange inflows and outflows can provide early warning signs of potential market shifts.

- Analyse Open Interest: Changes in open interest can indicate the strength of market sentiment. Rising open interest often suggests increased bullishness, while declining open interest may point to a loss of conviction.

- Combine Multiple Indicators: No single metric tells the whole story. Integrate exchange flows, open interest, price action, and other essential and technical indicators for a comprehensive view of the market.

BNB’s recent performance showcases the power of fundamental strength and market demand. While exchange flows can indicate temporary selling pressure, a healthy underlying ecosystem and persistent buying interest can drive sustained price growth. as the cryptocurrency market evolves, understanding these complex market forces becomes increasingly crucial for success.

BNB price Prediction: Will demand Push it Higher?

The price of Binance Coin (BNB) shows signs of strength, driven by growing demand. Whether this momentum continues into the upcoming week depends on various factors.

Recent market activity suggests a potential surge in BNB’s value. “Shoudl this demand keep rising, BNB could continue to surge moving into the week.”

BNB’s performance in recent weeks has been closely tied to broader market trends. The cryptocurrency market is known for its volatility, and BNB’s price can fluctuate significantly in response to news, regulatory developments, and investor sentiment.

While the positive outlook for BNB is encouraging,investors should be cautious. It’s crucial to conduct thorough research, understand the risks associated with cryptocurrency investments, and make informed decisions based on their own financial circumstances and risk tolerance.

Staying informed about market developments and news related to BNB and the wider cryptocurrency ecosystem is essential. Reliable sources of information include reputable news outlets, industry publications, and official announcements from Binance.

What is your outlook on the future price of BNB, and what factors do you believe will influence its trajectory?

BNB Price Surge: An Interview with Crypto Analyst, Ava Daniels

Binance Coin (BNB) has been on a notable upswing recently. We sat down with Ava daniels, a seasoned cryptocurrency analyst, to get her perspective on the factors driving this surge and what it means for the future of BNB.

Q: Ava, BNB has seen a significant price rally in recent days. What are the key drivers behind this upward movement?

“Several factors are contributing to BNB’s price surge. The most notable is the Continued growth of the Binance Smart Chain (BSC) ecosystem. We’ve witnessed a considerable increase in the total value locked (TVL) within protocols on BSC, which indicates growing confidence in its platform. This, coupled with heightened buying activity from perpetual market traders, creates a bullish momentum that’s pushing the price higher.”

Q: you mentioned the growing TVL on BSC.Can you elaborate on its significance?

“Absolutely. The TVL essentially reflects the amount of cryptocurrency locked into decentralized applications (dApps) and smart contracts on a particular blockchain. A rising TVL signifies increased user engagement, developer activity, and overall ecosystem health. It’s a strong indicator that investors and developers are confident in the long-term prospects of BSC, which, in turn, benefits BNB.”

Q: What about the surge in buying volume on perpetual markets? How does that play a role?

“Perpetual markets are a type of derivative contract that allow traders to speculate on the future price of an asset without an expiration date. The fact that the Taker Buy Sell Ratio on major exchanges has surged well above 1 suggests that there’s substantially more buying pressure than selling pressure in the market. Traders are clearly bullish on BNB and are placing bets on its further price appreciation.”

Q: looking ahead, what do you foresee for BNB’s price trajectory?

“The combination of a rising TVL, increasing buying pressure, and a generally positive trend in the wider cryptocurrency market points to a positive outlook for BNB. However, it’s important to remember that the market can be volatile. It’s crucial for investors to do their own research, understand the risks involved, and make informed decisions based on their individual circumstances.”

Q: Any final thoughts for our readers on BNB or the cryptocurrency market in general?

“The cryptocurrency market is constantly evolving, presenting both opportunities and challenges. It’s crucial to stay informed,adapt to changing trends,and never invest more than you can afford to loose. With careful research and a long-term perspective,cryptocurrency investing can be a rewarding journey.”